Current Uranium Futures Prices: Trends and Analysis

Are uranium futures prices poised for a significant shift? With the current price of UxC Uranium U3O8 Futures at 77.75 USD/LBR, having risen 2.67% in the past 24 hours, investors and industry participants are keenly watching the market.

Unlike other commodities such as gold or oil, uranium is not traded on a formal exchange. Instead, private organizations like UxC, LLC, monitor market activities to develop price indicators.

We will examine the current state of the uranium futures market, highlighting key trends and analysis that impact this specialized commodity market.

Key Takeaways

- Understanding the current uranium futures price and its trends.

- Examining the differences between uranium futures and other commodity futures.

- The significance of uranium futures as a financial instrument.

- How price movements affect the broader nuclear energy sector.

- Key factors influencing the uranium market.

Understanding the Uranium Futures Market

The uranium futures market plays a vital role in the nuclear energy industry, providing a platform for price discovery and risk management. As a critical component of the global energy mix, uranium futures enable participants to navigate the complexities of the uranium market.

What Are Uranium Futures Contracts?

Uranium futures contracts are agreements to buy or sell a specific quantity of uranium at a predetermined price on a particular date. These contracts are traded on exchanges like the CME/COMEX, providing a transparent and regulated environment for market participants.

The UxC Uranium U3O8 Futures Market Structure

The UxC Uranium U3O8 Futures market operates under the auspices of the CME/COMEX exchange, with the Ux U3O8 Price serving as the settlement price for the UxC Uranium U3O8 Futures Contract (UX). This structure ensures that the market is aligned with industry-accepted price indicators.

Key Trading Terminology for Uranium Futures

Understanding key trading terminology is essential for navigating the uranium futures market. Terms like contango, backwardation, and basis risk are crucial for market participants to manage their risk exposure effectively.

By grasping these concepts, investors and industry professionals can better navigate the uranium futures market, leveraging its potential for price discovery and risk management.

Current Uranium Futures Price Data

We examine the latest uranium futures price data to uncover trends and patterns in the market. The current price data for UxC Uranium U3O8 futures contracts is crucial for traders and investors looking to make informed decisions.

Latest UxC Uranium U3O8 Futures Prices

The latest prices for UxC Uranium U3O8 futures are available, including front-month and deferred contract prices across the futures curve. As of today, the prices reflect the current market sentiment and activity.

Price Performance Analysis

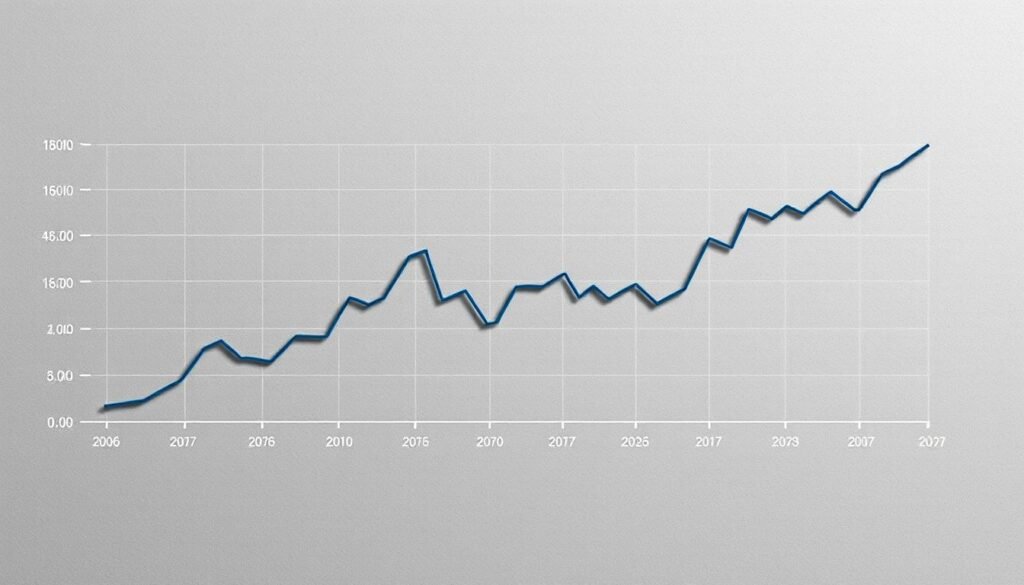

Analyzing the recent price performance of UxC Uranium U3O8 futures reveals significant movements and trends. Comparing current price levels to historical benchmarks over various timeframes provides valuable insights into market dynamics. The price chart shows the fluctuations in uranium futures prices, helping traders identify key support and resistance levels.

Volume and Open Interest Indicators

The current open interest in UxC Uranium U3O8 futures stands at 150.00 contracts. This metric is crucial for understanding market participation and trend strength. A declining open interest indicates that traders are closing their positions, suggesting a weakening trend. We also examine the trading volume to gauge market activity and sentiment.

By analyzing the current uranium futures price data, including price performance, volume, and open interest indicators, traders can better understand the market’s direction and make more informed trading decisions.

Uranium Futures Price Trends and Technical Analysis

Technical analysis plays a vital role in navigating the uranium futures market, helping traders make informed decisions. Today, the technical rating for UxC Uranium U3O8 Futures is “strong buy,” indicating a potentially favorable market condition. However, it’s crucial to conduct thorough research as market conditions can change rapidly.

Short-Term Price Movements

We analyze short-term price movements to identify key technical patterns in recent trading sessions. These patterns can provide insights into potential future price actions. By examining the charts, we can identify trends and patterns that may influence trading decisions.

Medium to Long-Term Price Trends

Examining medium to long-term price trends helps us understand the broader market cycles and multi-year price developments in the uranium market. This analysis is crucial for traders looking to make informed decisions based on historical data and market sentiment.

Technical Indicators and Market Sentiment

Various technical indicators, including moving averages and momentum oscillators, are used to forecast potential price movements. Currently, the market sentiment is leaning towards a “strong buy” signal. We assess these indicators and sentiment to provide a comprehensive view of the market. Key support and resistance levels on the price charts are also identified to guide trading decisions.

Factors Influencing Uranium Futures Prices

Understanding the factors that affect uranium futures prices is crucial for investors. The uranium futures market is influenced by a multitude of factors, including geopolitical events, nuclear energy demand, supply constraints, and currency movements.

Geopolitical Developments and Market Impact

Geopolitical tensions, particularly in key uranium-producing regions, significantly impact uranium futures prices. Recent events, such as the tentative ceasefire between Israel and Iran, have shown how quickly market conditions can change. The relationship between uranium and other commodities like gold, which has reached record highs amid geopolitical uncertainties, is also noteworthy.

Nuclear Energy Demand and Policy Changes

Changes in nuclear energy policies across major economies influence long-term demand projections and, consequently, futures prices. As governments reassess their energy strategies, the demand for uranium is affected. We examine how these policy changes impact the uranium market and its future prospects.

Supply Constraints and Production Dynamics

Supply constraints in the uranium production sector, including mining disruptions, production costs, and inventory levels, affect market conditions. We evaluate these factors and their impact on uranium futures prices, considering how they contribute to price volatility.

The uranium futures market is also influenced by currency movements, investment flows into uranium-related financial products, and technological developments in nuclear energy. As the global energy landscape evolves, understanding these factors becomes increasingly important for investors and market participants.

Conclusion: Outlook for Uranium Futures Market

Our examination of the uranium futures market reveals a complex interplay of factors influencing prices and trading activity. As we synthesize the key insights from our analysis, we provide a comprehensive outlook for the uranium futures market over the short, medium, and long term.

The balance of bullish and bearish factors currently influencing uranium futures prices is delicate. We evaluate these factors and discuss potential price scenarios based on different market conditions and geopolitical developments that could materialize in the uranium sector.

Important indicators and news developments that market participants should monitor to stay informed about uranium futures price trends include changes in market activity, price reporting mechanisms, and investor interest. The evolution of price reporting mechanisms, such as UxC’s shift from weekly to daily price publications, reflects increasing market activity and may influence future trading patterns.

As institutional investor interest in uranium as an alternative asset class evolves, it is likely to impact futures market performance over the coming years. We consider how uranium futures trading might develop as a financial market, including potential changes in contract specifications, trading volumes, and market participation.

In conclusion, the strategic importance of uranium futures for different market participants, from miners and utilities to financial traders and energy market analysts, cannot be overstated. As the market continues to evolve, staying informed about the latest developments and trends will be crucial for making informed investment decisions.