The Inflation Formula Explained: What You Need to Know

A dollar today can buy 93% less than it could in 1913, the Bureau of Labor Statistics says. This shows how prices quietly take away your buying power over years.

Learning about inflation calculation helps you make better money choices. Many think prices go up in a simple way, but they actually grow faster. For example, a 3% yearly increase on a $100 grocery bill doesn’t just add $3 each year.

The basic inflation formula works like compound interest but in reverse. It shows how money loses value over time through math. This means small yearly increases can have a big effect on your budget over time.

Knowing these calculations helps you plan for the future. It’s useful for retirement, salary talks, and understanding the economy. Whether you’re a business owner or a consumer, this knowledge keeps your money safe.

Key Takeaways

- Price increases follow exponential patterns, not straight-line growth

- Small annual rates compound into significant long-term purchasing power loss

- The basic calculation uses Present Value × (1 + rate)^periods structure

- Understanding these concepts helps with retirement and salary planning

- Business owners need this knowledge for accurate cost forecasting

- Economic trends become clearer when you grasp compound effects

What Inflation Really Means for American Consumers Today

Grasping the true effect of inflation on your wallet is key to making better financial decisions. Prices are set to go up 2.3% in 2023. This means your money doesn’t stretch as far as it did last year. It’s not just a theory; it’s real in your grocery store, gas station, and all spending places.

Rising Prices and Purchasing Power Decline

Let’s look at a clear example. In January 2021, $7 could buy two gallons of milk at $3.47 each. But by January 2023, that $7 only got you one gallon at $4.20. Your money’s value went down, even though you had the same amount.

This trend is seen in all household costs. Rent, groceries, utilities, and transportation costs keep going up. Yet, many wages don’t keep pace. This leaves you with a smaller paycheck each month. You’re forced to make hard choices about where to spend your money.

Why Understanding Inflation Matters Now

Understanding inflation helps you plan for the future. When economists track inflation, they’re looking at how life gets more expensive over time. This knowledge lets you ask for better pay, adjust your budget, and make smart choices about big buys.

The Federal Reserve tries to manage inflation with interest rate changes. But you still feel the pinch of higher prices. Knowing these economic forces helps you adjust your financial plan. It helps protect your family’s quality of life.

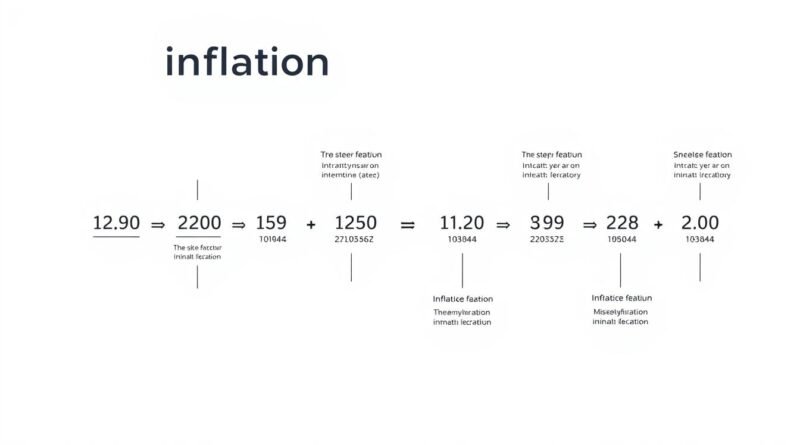

The Core Inflation Formula Every American Should Know

The inflation calculation shows how your money’s value changes over time. It’s key to knowing how prices rise and how they affect your money. This formula helps you see how inflation impacts your budget and financial goals.

The basic inflation formula is easy to grasp: Future Value = Present Value × (1 + inflation rate)^number of periods. It explains how money grows or shrinks over years.

Breaking Down the Basic Calculation

Each part of this formula has a role. The Present Value is your starting money. The inflation rate is the yearly price increase. The number of periods is how many years you’re looking at.

Here’s what each part means:

| Variable | Definition | Example |

|---|---|---|

| Present Value | Current dollar amount | $100 |

| Inflation Rate | Annual price increase percentage | 10% (0.10) |

| Number of Periods | Years being calculated | 5 years |

| Future Value | Adjusted dollar amount | $161.05 |

Step-by-Step Formula Application

Let’s use the formula with a real example. Start with $100 today. Assume 10% annual inflation for five years.

Step 1: Turn the percentage into a decimal (10% = 0.10). Step 2: Add 1 to the decimal (1 + 0.10 = 1.10). Step 3: Raise this to the power of years (1.10^5 = 1.61051).

Step 4: Multiply by your starting amount ($100 × 1.61051 = $161.05). This shows exponential growth. Your $100 doesn’t just gain $50 over five years. It actually needs $161 to buy the same things.

Understanding compound inflation helps Americans make better decisions about savings, investments, and big purchases.

Consumer Price Index Formula: Tracking Your Cost of Living

The Consumer Price Index is America’s main tool for tracking prices over time. It shows if your money goes further than last year. The U.S. Bureau of Labor Statistics updates CPI data monthly, helping us see price trends.

How CPI Measures Price Changes

The CPI formula compares today’s prices to a base period, usually set at 100. To find the inflation rate equation, it’s simple: (Current Period Price ÷ Base Period Price) × 100.

For instance, if milk was $2.50 in 2020 and $3.00 now, the CPI would be ($3.00 ÷ $2.50) × 100 = 120. This shows milk prices went up 20% since then.

Market Basket Methodology Explained

The market basket includes hundreds of items that show what Americans typically buy. Economists ask thousands of families about their purchases. This basket covers housing, food, transportation, and more.

The Bureau of Labor Statistics updates this basket every two years. They track prices for things like gasoline and rent in different cities. This makes sure the inflation rate equation shows real-life spending.

Weighted Average Calculations

Not all items in the market basket are treated equally. Housing costs are more important because families spend more on rent and mortgages. This is different from spending on coffee or newspapers.

| Category | Weight Percentage | Example Items |

|---|---|---|

| Housing | 42.4% | Rent, utilities, furniture |

| Transportation | 15.8% | Gasoline, car payments, public transit |

| Food | 13.4% | Groceries, restaurant meals |

These weights make sure the inflation rate equation really shows how price changes affect our budgets. If housing costs go up faster, it affects inflation more.

GDP Deflator Formula: Economy-Wide Price Measurement

The GDP deflator looks at inflation across all goods and services made in the country. It’s different from the Consumer Price Index, which only looks at what people buy. The GDP deflator shows price changes in every part of the American economy, from business investments to government spending.

To find the GDP deflator, you divide nominal GDP by real GDP and then multiply by 100. This shows how much of the growth is from real production versus price increases. Knowing this helps economists and policymakers make better decisions.

Understanding Nominal vs Real GDP

Nominal GDP uses today’s prices to measure economic output. When prices go up, nominal GDP looks like it’s growing, even if production doesn’t. This can give a wrong idea of how the economy is doing.

Real GDP, on the other hand, uses constant prices from a base year. This removes the effect of price changes, showing true growth. For example, if nominal GDP goes up 5% but inflation is 3%, real GDP growth is only 2%.

The GDP deflator helps show how much inflation affects nominal GDP growth. This is key for figuring out cost of living adjustments in government programs and wage talks.

Broad Economic Price Tracking

The GDP deflator tracks price changes in all sectors of the economy. It includes business equipment, government purchases, and export prices. This wide view is useful for seeing inflation trends across the economy.

Economists use this broader view to spot inflation sources that consumer indices might miss. Supply chain issues affecting business investments show up in GDP deflator calculations before they hit consumer prices. This early warning helps policymakers tackle inflation better.

| Measurement Type | Scope | Best Use Case | Update Frequency |

|---|---|---|---|

| GDP Deflator | All domestic production | Economy-wide analysis | Quarterly |

| Consumer Price Index | Consumer purchases only | Household budget planning | Monthly |

| Producer Price Index | Business input costs | Supply chain monitoring | Monthly |

| Personal Consumption Expenditures | Consumer spending patterns | Federal Reserve policy | Monthly |

Cost of Living Adjustment Formula in Action

Millions of Americans get help from Cost of Living Adjustments. These adjustments keep their money’s value steady as prices go up. Unlike the gdp deflator formula for big economic studies, COLA uses Consumer Price Index data for real income changes.

COLA formulas are simple but very effective. They turn complex economic data into real money that helps keep living standards up.

Social Security COLA Calculations

Social Security benefits get a yearly boost based on the third-quarter CPI. The Social Security Administration compares this year’s CPI-W to last year’s. If prices went up 3%, so do benefits.

This helps over 67 million Americans keep their retirement money’s value. It does this without needing Congress to act.

Federal Employee Salary Adjustments

Federal workers and military get pay boosts through COLA. These boosts consider national inflation and local cost differences. Location-based adjustments help because living costs change a lot across the U.S.

The Office of Personnel Management uses Employment Cost Index data for these salary increases.

Regional Price Variations

COLA must consider price differences by region. Inflation hits places like San Francisco and rural Kansas very differently.

| Region Type | Typical COLA Rate | Primary Cost Drivers | Adjustment Frequency |

|---|---|---|---|

| High-Cost Urban | 15-25% above base | Housing, Transportation | Annual Review |

| Moderate Urban | 5-15% above base | Healthcare, Utilities | Annual Review |

| Rural Areas | Base Rate | Food, Energy | Bi-annual Review |

| Remote Locations | 10-30% above base | Transportation, Goods | Quarterly Review |

Knowing these regional differences helps employees get fair pay and plan their careers better.

Price Index Calculation Methods Used by Economists

Different price index calculation methods help track economic changes. Economists use three main ways to measure price changes. Each method gives unique insights but has its own math.

These methods are behind the inflation numbers in news. Knowing these approaches shows why inflation rates can differ. The choice of method greatly affects the results.

Laspeyres Price Index Applications

The Laspeyres method uses a fixed basket of goods from a base year. It keeps the same items and amounts for all calculations. Governments like it for consistent comparisons over time.

The Social Security Administration uses Laspeyres for cost-of-living adjustments. It’s good for tracking policy impacts. But, it might show too high inflation if people buy cheaper items.

Paasche Price Index Benefits

Paasche updates the basket of goods for each period. This method shows current consumer spending patterns better than fixed baskets. It reflects how people shop in different economic times.

This method usually shows lower inflation rates than Laspeyres. It handles price changes well. Retailers and market researchers like it for understanding consumer behavior.

Fisher Price Index Accuracy

The Fisher method combines Laspeyres and Paasche approaches. It takes the geometric mean of both to balance biases. This makes for more balanced and accurate inflation measurements.

Federal Reserve economists often use Fisher for policy decisions. It gives a full view of price changes. Many see it as the best for long-term inflation trends.

Inflation Rate Equation: From Monthly to Annual Trends

The inflation rate equation turns short-term price changes into long-term trends. Most government agencies share monthly inflation data. But, people and investors need annual figures for better decisions. Knowing how to convert these helps us understand economic reports better.

Financial planners use these calculations every day. They change monthly rates to compare investments. This shows real inflationary trends analysis patterns that monthly data might not show.

Converting Monthly Data to Annual Rates

The basic formula multiplies monthly rates by twelve. But, this simplifies the calculation too much. Economists use compound interest instead. The correct formula is: Annual Rate = (1 + Monthly Rate)^12 – 1.

Let’s say monthly inflation is 0.3%. The annual rate would be (1.003)^12 – 1 = 3.66%. Just multiplying by twelve gives 3.6%. This inflationary trends analysis method gives a more accurate forecast.

Seasonal Adjustment Techniques

Raw inflation data shows seasonal patterns that hide true trends. For example, holiday shopping and energy costs change prices. Economists adjust for these patterns to show real inflationary trends analysis movements.

The Bureau of Labor Statistics uses X-13 software for these adjustments. This software finds and removes seasonal patterns from historical data. It shows the underlying inflationary trends analysis movements.

| Time Period | Raw Monthly Rate | Seasonally Adjusted Rate | Annual Equivalent |

|---|---|---|---|

| January | 0.1% | 0.2% | 2.4% |

| July | 0.5% | 0.3% | 3.7% |

| December | 0.4% | 0.2% | 2.4% |

Real-World Price Level Measurement Examples

Real data from key sectors shows how inflation affects American families. These examples show macroeconomic inflation indicators in action. They help families see how inflation changes their daily lives through price changes in housing, food, energy, and healthcare.

Housing Market Inflation Calculations

Housing costs are a big expense for most families. The median home price went from $140,000 in 2000 to $428,700 in 2023. This is a 206% increase over 23 years.

The inflation rate for housing is 5.0% each year. Rent prices also rose, from $602 monthly in 2000 to $1,326 in 2023.

Food and Energy Price Tracking

Food and energy prices have seen big jumps, affecting family budgets. Milk prices went from $2.55 per gallon in January 1996 to $4.20 in January 2023. This is a 64.7% inflation rate over 27 years.

Gasoline prices have also seen huge increases. From $1.14 per gallon in January 2002 to $3.23 in July 2021, prices rose by 183%. This is a 183% increase.

Healthcare Cost Inflation Analysis

Healthcare inflation is much higher than general price increases. Health insurance premiums went from $2,471 annually in 1999 to $8,435 in 2023. This is a 242% increase, much higher than overall inflation.

These examples show how macroeconomic inflation indicators help Americans track rising costs. They help plan their financial futures.

Current Inflationary Trends Analysis Across America

To understand today’s inflation, we must look at real-world factors. These factors drive price changes across America. The inflation formulas we’ve studied come alive in today’s economic conditions. Consumer prices are expected to rise 2.3% in 2023, showing the pressures on the American economy.

These trends are connected to the math we’ve explored. When economists calculate inflation rates, they measure the same forces. These forces affect your grocery bill and housing costs today.

Federal Reserve Policy Responses

The Federal Reserve fights inflation by raising interest rates. Higher rates make borrowing more expensive for everyone. This policy tool directly impacts the price level measurements we’ve discussed.

When the Fed raises rates, it changes your mortgage payments, credit card costs, and savings account returns. These changes affect the economy, showing up in the Consumer Price Index calculations we learned about earlier.

Supply Chain Disruption Effects

Global supply chain issues lead to local price increases. When shipping costs rise or materials become scarce, these increases flow to consumer prices.

Supply chain disruptions create the price changes in our inflation formulas. Factory shutdowns in one country can drive up costs for American consumers. This shows how connected our economy is.

Labor Market Wage Pressures

Worker demands for higher wages contribute to inflation cycles. As employees seek raises to keep up with rising costs, businesses often pass these expenses to consumers through higher prices.

This creates a feedback loop where wage increases lead to price increases. This loop explains why inflation can persist even after initial triggers disappear.

| Inflation Driver | Current Impact | Consumer Effect | Policy Response |

|---|---|---|---|

| Interest Rates | 5.25% Federal Rate | Higher borrowing costs | Continued monitoring |

| Supply Chains | Gradual improvement | Stabilizing goods prices | Trade policy adjustments |

| Labor Markets | Wage growth 4.2% | Service price increases | Employment data tracking |

| Energy Costs | Volatile pricing | Transportation impacts | Strategic reserve releases |

Macroeconomic Inflation Indicators Economists Watch

Economists look at more than just basic inflation rates. They use special indicators to get a deeper look at price changes. These inflation indicators are like pieces of a puzzle. Each one shows a different part of how prices move.

Analysts use many measures because one indicator isn’t enough. Some focus on certain sectors, while others look at bigger trends. Knowing these differences helps you understand economic news better.

Core vs Headline Inflation Differences

Core inflation doesn’t count food and energy prices. These prices can change a lot because of weather, politics, and seasons. Headline inflation, on the other hand, includes everything people buy.

The Federal Reserve often looks at core inflation for policy decisions. This helps them see long-term price trends without short-term changes. But, headline inflation is more important for your daily budget because it includes things like gas and groceries.

Personal Consumption Expenditures Index

The PCE Index shows what Americans spend money on each month. It’s different from other price index calculations because it changes when people choose cheaper options. This makes it more realistic.

Federal Reserve officials like PCE for setting interest rates. It’s better at showing how shopping habits change than fixed market baskets. This helps them understand economic trends better.

Producer Price Index Connections

Producer prices track costs at the wholesale level before goods reach consumers. When wholesale costs go up, retail prices often follow a few months later. This gives an early warning about price changes.

| Inflation Indicator | Primary Focus | Key Advantage | Policy Use |

|---|---|---|---|

| Core Inflation | Underlying trends | Removes volatility | Federal Reserve decisions |

| Headline Inflation | All consumer prices | Complete picture | Public communication |

| PCE Index | Actual spending patterns | Adjusts for substitution | Monetary policy target |

| Producer Price Index | Wholesale costs | Early warning signals | Supply chain analysis |

Smart investors and policymakers watch all these indicators together. Each one gives unique insights into future price trends.

Common Errors in Inflation Calculation and Analysis

Knowing where inflation calculations go wrong is key to making smart money moves. Mistakes can lead to wrong conclusions about the economy and poor financial choices.

Data Selection and Quality Issues

Poor data selection is a major issue in measuring inflation. Many use incomplete or unreliable data. Government agencies offer the most accurate info, but some prefer easier options.

Always check if your data comes from trusted sources like the Bureau of Labor Statistics. Look out for missing months or revised numbers that could alter your findings.

Time Period and Base Year Problems

Choosing the wrong base year can mess up your inflation calculation. Some pick unusual years with big price swings as their base. This leads to misleading comparisons.

Choose a normal economic period for your base year. Avoid years with big recessions, wars, or market disruptions that don’t show typical conditions.

Substitution Bias Challenges

Substitution bias occurs when price increases lead to changes in what people buy. Traditional price measurement methods often miss these changes.

For example, if beef prices go up, families might start buying more chicken. But traditional market baskets don’t show this shift.

Today’s inflation calculations try to account for these changes. But older methods are still seen in many reports.

Conclusion

Learning about inflation formulas is key for smart money management. These tools help you plan your spending, saving, and investments in today’s economy.

The Consumer Price Index and GDP deflator might seem hard at first. But, once you understand them, they become very useful. They affect your money in many ways.

Inflation impacts your daily life, from buying groceries to planning for retirement. The methods we talked about help you see price trends. This way, you can make better choices about investments and big purchases.

Cost of living changes affect Social Security and federal salaries. Also, prices vary by region, which can influence where you live and work. Knowing these formulas helps you ask for fair pay during inflation.

Price index calculations show economic patterns that guide your financial choices. They help you understand housing and healthcare costs, even in uncertain times.

With this knowledge, you can handle economic ups and downs better. The inflation rate equation helps you set long-term financial goals. These formulas give you the power to make wise money decisions, no matter the economy.

An outstanding share! I have just forwarded this onto a

friend wwho has been doing a little ressearch on this.

Andd hhe in fact ordered me breakfast because I found it for him…

lol. So allow me to reword this…. Thanks for the meal!! But yeah, thanks for spending thee time to

discuss this topic here onn your internet site. http://boyarka-Inform.com/

Reading this feels like tracing familiar shapes with renewed awareness. Each sentence fosters patience, observation, and reflection, allowing subtle insights and layered understanding to emerge.